The Government of India has launched a scheme namely, Trade Infrastructure for Export Scheme (TIES) from FY 2017-18 with the objective to assist Central and State Government Agencies for creation of appropriate infrastructure for growth of exports from the States. The Scheme provides financial assistance in the form of grant-in-aid to Central/State Government owned agencies for setting up or for up-gradation of export infrastructure as per the guidelines of the Scheme. The scheme can be availed by the States through their Implementing Agencies, for infrastructure projects with overwhelming export linkages like the Border Haats, Land customs stations, quality testing and certification labs, cold chains, trade promotion centres, dry ports, export warehousing and packaging, SEZs and ports/airports cargo terminuses. The Scheme guidelines are available at http://commerce.gov.in.

Under the TIES Scheme, a total of 28 export infrastructure projects have been provided financial assistance during FY 2017-18, 2018-19 and 2019-20 (as on 1st July, 2019). The state-wise and Year-wise details of projects, located in various States/UTs, is given at Annexure-I.

The Government of India strives to ensure a continuous dialogue with the State Governments and Union Territories on measures for promoting exports and for providing an international trade enabling environment in the States, and to create a framework for making the States active partners in boosting exports from India.

Under the Foreign Trade Policy (FTP), DGFT operates various Export promotion schemes such as Advance Authorization, Duty Free Import Authorization, Export Promotion of Capital Goods, Merchandise Exports from India Scheme (MEIS) and Services Exports from India Scheme (SEIS). To give effect to these schemes, Central Board of Indirect Taxes and Customs has issued various exemption notifications. The details of various exemptions provided for these schemes are given in the FTP.

MEIS was introduced in the FTP from 01.04.2015, providing rewards for exporters of specified goods. The objective of the MEIS is to offset infrastructural inefficiencies and associated costs involved in exporting goods/products which are produced/manufactured in India. The scheme incentivizes exporters in terms of Duty Credit Scrips at the rate of 2, 3, 4, 5, 7 % of FOB Value of exports realized. These scrips are transferable and can be used to pay certain Central Duties/taxes including Customs Duties.

As regards promotion of trade in services, Government of India provides fiscal benefits through Services Exports from India Scheme (SEIS) for some identified sectors. Government of India is following a multi-pronged strategy, including negotiating meaningful market access through multilateral, regional and bilateral trade agreements, trade promotion through participation in international fairs/exhibitions and focused strategies for specific markets and sectors to promote Trade in Services. An ‘Action Plan for Champion Sectors in Services’ has also been approved in February, 2018 to give focused attention to 12 Champion Services Sector like Information Technology / Information Technology Enabled Services, Tourism and Hospitality Services and Medical value Travel.

The Agriculture Export Policy was launched in 2018 to harness export potential of Indian agriculture, through suitable policy instruments, to make India global power in agriculture and raise farmers’ income. This comprehensive “Agriculture Export Policy” aims to increase agricultural exports by integrating Indian farmers and agricultural products with the global value chains.

Section 10AA of the Income-tax Act, 1961 provides for deduction of profits and gains derived from the export of articles or things or from services in respect of newly established Units in Special Economic Zones. Such deduction is allowed to an entrepreneur as referred to in clause (j) of section 2 of the Special Economic Zones Act, 2005, from his Unit, who begins to manufacture or produce articles or things or provide any services during the previous year relevant to any assessment year commencing on or after the 1st day of April, 2006, but before the first day of April, 2021. The deduction is allowed as under:hundred per cent of profits and gains derived from the export, of such articles or things or from services for a period of five consecutive assessment years beginning with the assessment year relevant to the previous year in which the Unit begins to manufacture or produce such articles or things or provide services, as the case may be, and fifty per cent of such profits and gains for further five assessment years and thereafter.

For the next five consecutive assessment years, so much of the amount not exceeding fifty per cent of the profit as is debited to the profit and loss account of the previous year in respect of which the deduction is to be allowed and credited to a reserve account (to be called the "Special Economic Zone Re-Investment Reserve Account") to be created and utilized for the purposes of the business of the assesse in the manner laid down.

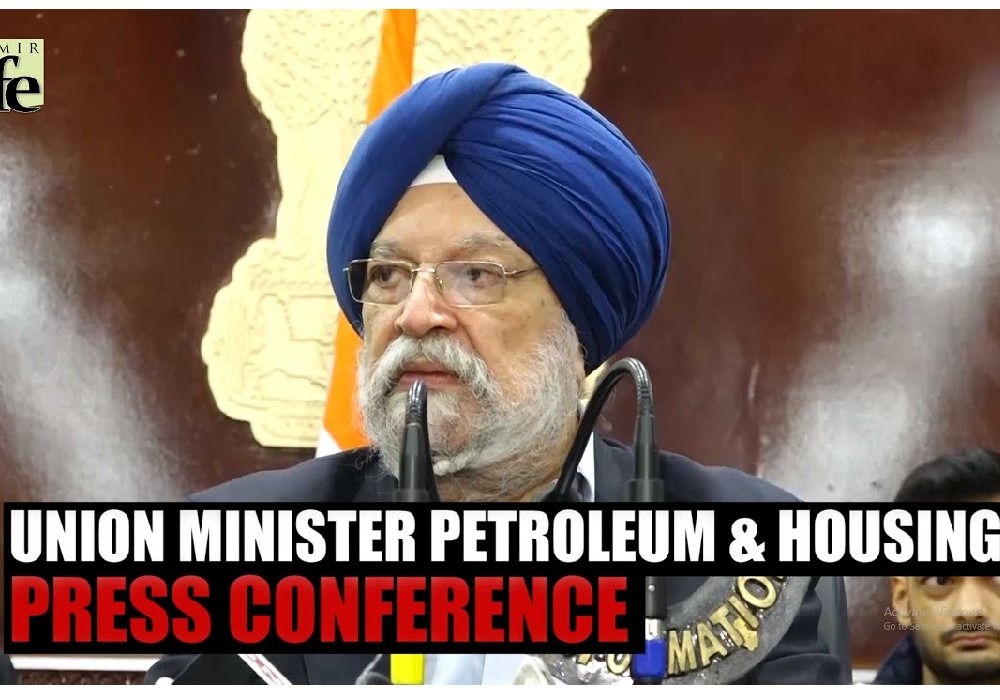

Synopsis Union Minister Hardeep Singh Puri stated India's commitment to an inclusive global energy future through open collaboration, highlighting the India-Middle ..

देश में एक करोड़ यात्री प्रतिदिन कर रहे हैं मेट्रो की सवारी: पुरी ..

Union Minister for Petroleum and Natural Gas and Housing and Urban Affairs, Hardeep Singh Puri addressing a press conference in ..

Joint Press Conference by Shri Hardeep Singh Puri & Dr Sudhanshu Trivedi at BJP HQ| LIVE | ISM MEDIA ..

(3).jpg)

"I wish a speedy recovery to former Prime Minister Dr Manmohan Singh Ji. God grant him good health," Puri wrote. ..